Given the atypical amount of time that I spend in Crapaud (for a non-resident), I have a particular interest in its geography–see Why is Crapaud Round? and the follow-up Did Crapaud incorporate “in order to purchase a short piece of fire hose?” (Or, How Crapaud came to be Round).

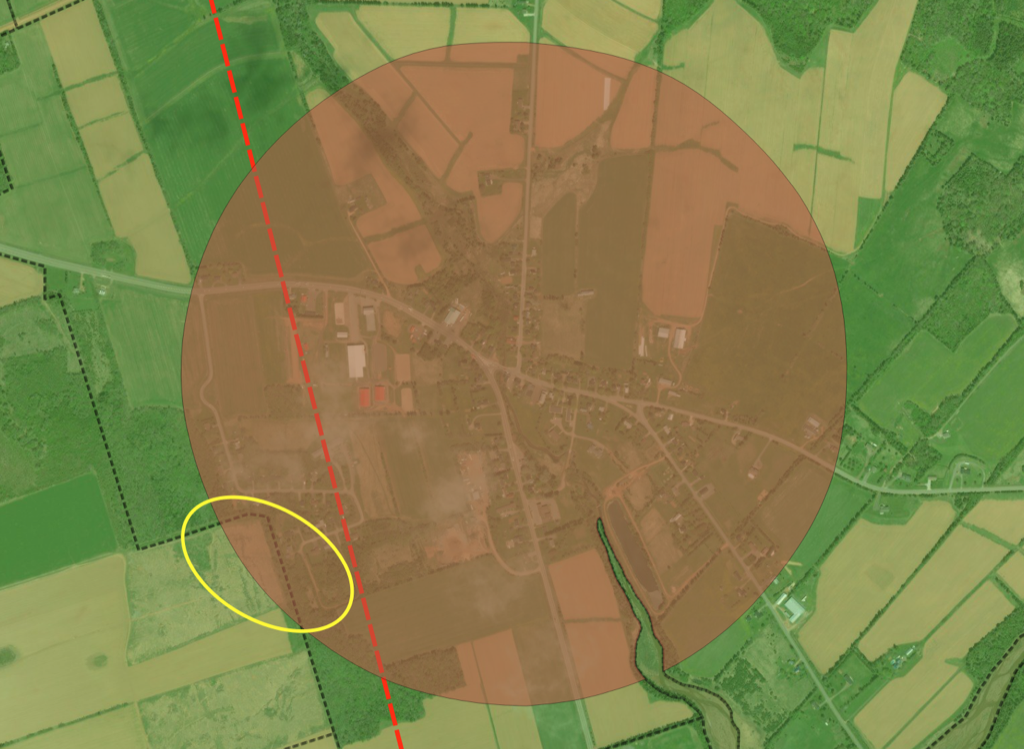

My study of Crapaud’s geography today led me to the issue of the village’s bisection by the Prince-Queens county line (the dashed red line on the map below). This means that part of Crapaud is in Prince County and part of it is in Queens County.

But it’s even more interesting than that, as in additional the boundary of the Rural Municipality of Crapaud–the circle with a radius of one-half mile from the “Crapaud corner,” shown as the brown circle on the map–there’s also the civic address community of Crapaud, a kind of parallel universe that is used by the civic addressing system (shown on the map with a black dashed line).

Oddly–though perhaps understandably given the clash of the round boundary with the non-round boundary–there’s a part of Crapaud (the municipality) that is not in Crapaud (the civic address community), but rather in Tryon, to the west.

I’ve circled this area in yellow on the map below: it’s about 11 acres in size, and this geographic dual nationality is not, I imagine, a day-to-day practical calamity as the area in question is part of one property (PID 456244) that fronts onto the Victoria Road and the Foy Road in Tryon, but has no civic addresses associated with it, as it’s not an improved property.

One wonders, however, whether the Rural Municipality of Crapaud levies taxes on its share of the property. More investigation needed.

I am

I am

Comments

I spoke with Taxation and

I spoke with Taxation and Property Records and asked how they handle a situation where a property is partly inside a municipality, and partly outside. Their answer was twofold: historically the practice has been to look at where the most valuable part of a property is—the house, for example—and if it falls inside the municipality, that’s where it’s taxed. Going forward—and I got the sense the details of this are being worked out now—they plan to use a proportional system, so a portion of the property tax will go to each jurisdiction proportional to the area in each.

Add new comment