Today is the most stressful financial day of the year for me — RRSP day. For those of you in the readership from outside of Canada, RRSPs — Registered Retirement Savings Plans — are tax-sheltered retirement investments that we Canadians can may each year. Basically we can each take a defined chunk of our income, place it in a special type of investment, and thus exempt ourselves from paying tax on the chunk in the current year; when we retire, the money comes out of the investment and we pay tax on it then, but by then we are in a lower tax bracket.

And we have until the last day of February to make the arrangements to do this each year.

And of course, given my laissez faire attitude towards my finances, I always wait until the last day in February to make the required arrangements.

The stress comes because the actual amount that Catherine and I are each permitted to invest is sent to us by Revenue Canada on the previous year’s “Notice of Assessment,” a piece of paper we are mailed once our previous year’s tax return is processed.

So to be effective today required locating those two pieces of paper, sent to us mid-2005. In a sea of other as-yet-unfiled paperwork stretching back quite a while.

Then Oliver and Catherine and I had to drive up to Metro Credit Union where we received characteristically good and stress-free service to complete the deal.

Did I mention that I hate scrounging for paperwork? I was sending out so much negative energy, that Johnny shouted over to make sure I wasn’t having a nervous breakdown.

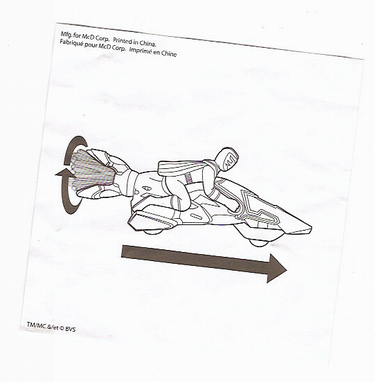

Anyway, it all worked out in the end. And in the process of sorting through my multi-year pile of un-filed miscellany I found what appears to be an instruction sheet for a rocket-powered motorcycle that I have no recollection of actually having acquired:

If you were with me when I purchased same, please let me know.

I am

I am

Comments

I think it may have come from

I think it may have come from a Kinder surprise egg.

Hey Peter, Actually, the

Hey Peter,

Actually, the cutoff is not the last day in February. You have the first 60 days of the new year to purchase RRSPs for the previous year, so the cutoff is March 2nd (or March 1st if it’s a leap year.)

Congratulations, you’re not as bad a procrastinator as you thought. :)

Wow, Peter…you just told the

Wow, Peter…you just told the story of my day too.

Wish I had a rocket powered motorbike to take off on for a while.

You could have phoned the tax

You could have phoned the tax center help line and gotten the numbers easily enough to save yourself from all the troubles of searching for it.

(I’ve been there.)

You’re safe with the

You’re safe with the rocketbike, Peter, I recognized that right away as a McDonald’s Happy Meal Toy - my 3-year old has one just like it :-)

Frankly, I find the idea of

Frankly, I find the idea of Peter eating at McDonald’s in his sleep equally scary.

Add new comment