I’ve been migrating my corporate bookkeeping over to AccountEdge (the final chapter of a saga that started 12 years ago).

One of the nice features of AccountEdge is that it automatically reverse-calculates the HST on purchases I enter. So, for example, if I enter a purchase of $115.00 and indicate it was HST-taxable, AccountEdge will automatically assign $15.00 of the amount to the “HST Paid” account.

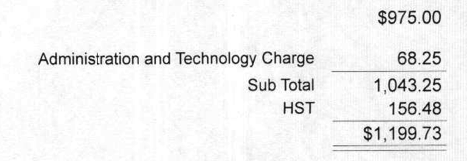

I was entering an invoice from my accountant into AccountEdge this week, a bill for $1043.25 plus HST:

I entered the total amount, $1199.73, and AccountEdge calculated the HST amount as $156.49, which was a penny more than the invoice indicated.

Doing the math:

1043.25 x 0.15 = 156.4875

The guidance from Canada Revenue Agency on rounding GST/HST amounts is this:

Round off the GST/HST to the nearest cent:

- If the amount is less than half a cent, you may round down.

- If the amount is equal to or more than half a cent, round up.

If your customer is buying more than one item and tax applies at the same rate on all items, you can total the prices of all taxable supplies of property and services, calculate the GST/HST payable, and then round off the amount.

Taking the 156.4875 and rounding thus, I get $156.49, as the 0.75 cents is equal to or more than half a cent.

Apparently the accounting software my accountant uses rounds differently, and thus I’m billed $156.48.

This is a bug, and likely one that nobody other than I will ever notice or worry about. But it bothers me.

I am

I am

Comments

This bothers me too. Yardi…

This bothers me too. The Yardi system doesn't do rounding properly, and payments coming from clients who use this system are always a penny short on their bills.

Add new comment