Beyond Catherine’s longstanding fundamental discomfort with the notion that, for the most part, I earned money and she didn’t, which we came to terms with as much as it’s possible to come to terms with, the only financial schism in our 28 years together was a home equity line of credit that we secured against our house at 100 Prince Street when we purchased it in 2000.

By lucky happenstance we were able to pay cash for our house when we bought it; it needed substantial renovations, though, and we didn’t have the cash for that, hence the line of credit, which was akin to a mortgage, but with a better rate, and much more flexible terms.

After the initial round of renovations, it was my intent that we pay off the line of credit and shut it down over the course of 3 or 4 years; I’m genetically programmed to be averse to debt of any sort, and I wanted it gone. Things didn’t work out that way, in part because other major expenses arose, and in part because Catherine and I disagreed as to the nature of the instrument: I treated it as a sacred crucible to be used gingerly; Catherine treated it as an infinite pile of free money. Neither of us was right-headed about it, really, and so discussion of the line of credit and its disposition became an occasional source of tension between us. Never enough to be a truly big deal; never not enough to truly recede into the background.

The Monday after Catherine died we got a letter from TD Bank, in the regular course of their affairs, informing us that the life insurance rate on the line of credit would be going up. This came as a surprise to me because I’d completely forgotten that we had life insurance on our line of credit. So I called the bank, found out that we did indeed, filled out some paperwork, and waited.

Wise financially-inclined friends, as well as CBC Marketplace, cautioned me that because line of credit insurance is “underwritten at time of claim,” I should be prepared to have the claim denied because that essentially means that the insurer does the investigative diligence at the end of the process, not at the beginning, as is typical with other types of life insurance.

And so I wasn’t banking on this happening. Which was okay, because I’d never been banking on it happening.

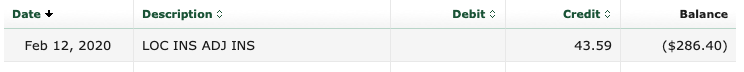

Today, though, I got a call from my friendly banking associated at TD Bank in Charlottetown telling me that the claim had been paid and that, once everything went through the wash, TD Bank owes me $286.40.

When I related the broad strokes of this story to my friend Dave last week, his reaction was “so Catherine was right!”

I hadn’t thought about it that way until that point, but Dave pegged it: our line of credit was much more infinite-pile-of-money than sacred-crucible.

She was right.

The hard fact of life and death means that Catherine will never know this, and that’s a shame.

For the first time in 25 years, I am debt free.

And while I would, in a heartbeat, give that up to have another hour with Catherine, it’s also an unexpected bit of good news in a run that hasn’t had a lot of that.

I am

I am

Add new comment