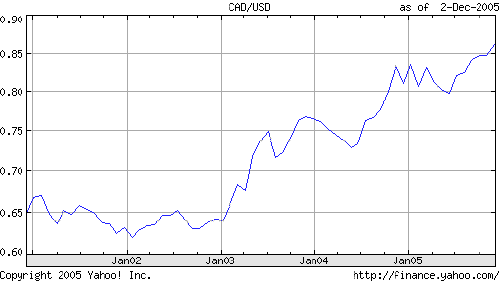

Here’s a 5-year chart (courtesy of Yahoo!) showing the value of the Canadian dollar vs. the U.S. dollar:

I know next to nothing about the currency market, and even less about trend lines and predicting, but it seems pretty clear to me that, all other things being equal, we’re heading for equivalence sometime in 2007.

Here’s a federal issue that it’s hard to know how to get behind. Certainly governments have marketed the lower Canadian dollar in recent years to those in the U.S„ especially Hollywood and tourists, as a reason for doing business with us — “your dollar goes farther,” etc.

As this benefit quickly slides away — which, if I understand economics correctly, is a generally good thing, economy-wise, as it means that others think Good Things about Canada, and thus consider our currency worthy of owning — I wonder what the federal stance should be now.

At some point does having a more-valuable currency have more of a downside than an upside?

Comments

China supposedly keeps its currency valued artificially low, which some talk about as unfair trade tactic. If you are a fairly self-sufficient country that exports more than you import, I suppose you want your currency low, so foreigners buy from you. But then you get so rich you start importing—is I guess the theory of global capitalism in a nutshell. Before that happens though we might just have to invade.

When your currency gets more valuable, exporting your goods becomes more expensive, meaning that your economy will grow less.

On the other hand, importing becomes cheaper. So wellfare in your country could rise (more cheap goods). And those cheap goods might be used in production to produce cheaper products, so the export might not be hurt as badly.

So who knows :)

To echo the comments above, it makes your goods more expensive to export, and can be a Bad Thing if it lasts too long.

I’ve read that it’s ridiculously expensive to do business in England because of the high cost of everything, even compared to Continental Europe. As for the Canadian dollar, when you look at it against the US dollar, which has been falling, it looks like it’s going up, but when you compare it agains the pound sterling or the Euro the rise isn’t nearly so dramatic.

The years of low dollar is also said to have killed our productivity incentive. So, technically we could overcome some of the negative impact of our suddenly expensive goods and services by becoming more efficient. That means no more procastinating!

When I was a kid the CDN buck was worth more than the US dollar.

Things were tough enough all around back then but we didn’t have the FTA and the NAFTA and of course the Confederation Bridge wasn’t there either. All of these things are worse when our dollar rises dramatically. I won’t draw the entire line from “here” to “there” but simply jump to the logical conclusion: primary industries in PEI are in for a terrible beating over the next few months/years, and shortly afterward small businesses will come under the same pressure.

Given how government has responded to economic development needs (with bungle after bungle punctuated very occasional successes), it seems clear that it will be individual creativity of Islanders that softens the comming blow (as it should be) — if in fact it is softened at all. Good luck everyone.

Oh, and prime interest rates are virtually certain to double by the time the full impact hits small business — 3-5 years.

It does seem folly that the US economy counts the Iraq war as economic activity and are showing growth because of it; economically they see the war as a “good thing”. But sanity would demand they consider it an expense that’s being deferred which is likely to generate even more interest rate pressure!

I agree that exporting will become more difficult but alot of companies that import high tech goods for use in manufacturing will see their costs go down. Considering this many companies could become more competitive on the international market even with a higher dollar.